Malaysian Car Sales to Fall

Sales of new vehicles in Malaysia are set to fall for the first time in six years as a perfect storm of subdued sentiment, a sluggis...

https://automology.blogspot.com/2016/01/malaysian-car-sales-to-fall.html

Sales of new vehicles in Malaysia are set to fall for the first time in six years as a perfect storm of subdued sentiment, a sluggish economy, the implementation of GST, weaker local currency and tighter lending requirements take its toll on the automotive industry, according to the Malaysia Automotive Association.

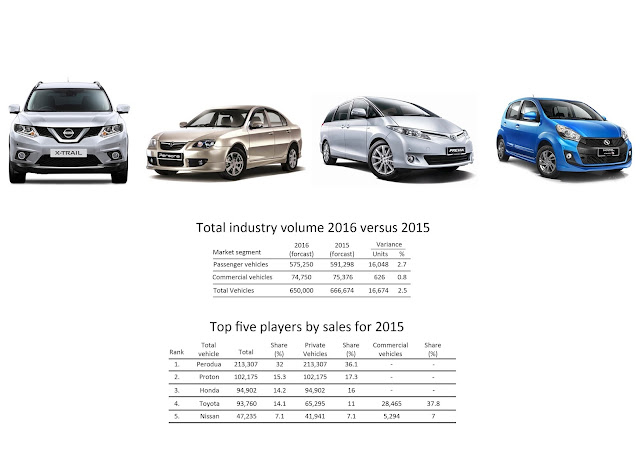

Auto dealers had battled throughout 2015 to attract new customers with attractive offers and cash-back deals, which led to a sixth year of growth in succession, with sales for the year of 666,674 units. However, the forecast for 2016 is gloomy, with analysts believing that the market will shrink by at least 2.5% to a total of just 650,000 for the year.

MAA President, Datuk Aishah Ahmad, explained that its members are forecasting a distinct downturn for the year, mainly due to the subdued global economic growth, uncertainties over the fall in crude oil price and the slowdown in China’s gross domestic products.

“Malaysia’s economy too is expected to expand at a slower pace of 4% to 5% this year and the ringgit (Malaysian Dollar) will continue to impact business confidence and consumer sentiment,” Datuk Aishah remarked at a press briefing.

Tighter lending conditions are also making things tough for the would-be buyer as the Government attempt to rein in household debt levels.

“We hope that banks will look into a leaner hire purchase loan guidelines. As of now most banks have shortened the hire purchase repayment period up to maximum of seven years from the previous nine years. This is expected to have an impact on the lower income group buying power. Inevitable and expected price increase will also be a factor,” said Datuk Aishah.

Malaysian brands, Perodua and Proton, managed to capture the biggest market share of 32% with 213,307 units sold and 15.3% with 103,175 units sold respectively. The result for Perodua is a record and seen as the reward for constantly striving to improve and offer affordable, quality product for the budget car market sector, in which it has excelled. Figures announced showed that the Perodua Axia accounted for 47% of their sales - this is the entry level and lowest cost car in Malaysia at present, priced as low as US$6,117.

The best performing foreign brand was Honda with 14.2% market share and total sales of 94,902 - narrowly beating out Toyota with 14.1% share with 93,760 units sold - although only 65,295 were passenger vehicles and the rest were commercial vehicles, a segment in which Honda does not compete in Malaysia.

Records were also set by Ford, which sold a total of 12,130 units. The Big Blue launched the new Ranger in October and for the year it accounted for the majority of Ford vehicles sold – 9,231 units or 76% of the total volume. The number was 7% higher than for 2014 and took the Ranger to the position of second best-selling pick-up truck in the country.

“Our new Ranger epitomises Ford’s proud truck heritage and global expertise, and is the most capable, most powerful and smartest truck in the market today. It’s everything our Malaysian customers have come to love about the Ranger, which is helping to further drive its widening appeal,” said David Westerman, MD for Malaysia and Asia Pacific Emerging Markets, Ford Motor Company. Things may be looking up for Ford in Malaysia with the launch of the new Ford Mustang very soon.

The aftersales market is also set to get tough in the new year, with all the major brands offering free or low-cost service packages designed to create brand allegiance. These efforts will undoubtedly squeeze out the smaller unaffiliated service centre operators who will need to look to maximising the spend of customers by adding additional services and products.

image: Malay Mail